Insurtechs: Use the Stages of Modernization and “Coretech Assembly Lines” to Engage P&C Insurers

P&C insurers follow a four-stage modernization pattern that governs how they interact with insurtechs. Coretech platform vendors have assembled customer communities that can be a valuable sales pipeline. Insurtechs that fail to understand these stages or fail to effectively partner with coretech vendors will miss key opportunities.

How about we talk again in a couple of years?

If you’re with an insurtech – perhaps a start-up providing an innovative solution to P&C insurers such as AI-enabled underwriting or IoT-enabled claims inspection – does this sound familiar?

You’ve made a real connection with a senior executive at a P&C insurer. He’s excited about your solution. Perhaps you’ve had a few meetings and a demo or two with your prospect. Your audience has expanded to a larger group of decision-makers at the company. Your team is getting excited about closing the deal and working with this new customer.

Then, out of the blue, the bottom falls out of this opportunity. Your prospect gives you an update – sincerely, apologetically – that sounds something like, “We love your solution. Your team seems awesome…but…we just signed a contract for a new policy administration system. We know we have to modernize. We need to do this first before we can really use cutting-edge solutions like yours. You know how these modernization initiatives go. We’re going to be “heads down“ on this for at least the next 18 months. Can we reconnect in a year or two?”

Scenarios like this – when high interest and engagement abruptly shift to “see you in a couple of years” – happen often with P&C insurers who are early in their modernization journey. These insurers follow a common pattern with four stages:

Status Quo (Legacy)

Exploration

Implementation

Post-Implementation (Modern Core)

At each stage, the insurer’s needs, level of interest, responsiveness, and ability to act, will change. As an insurtech, your ability to bring on a new P&C insurer customer will depend on how well you can identify where the insurer is in their modernization journey and meet their needs as they work through these stages.

Four Stages of Core Modernization

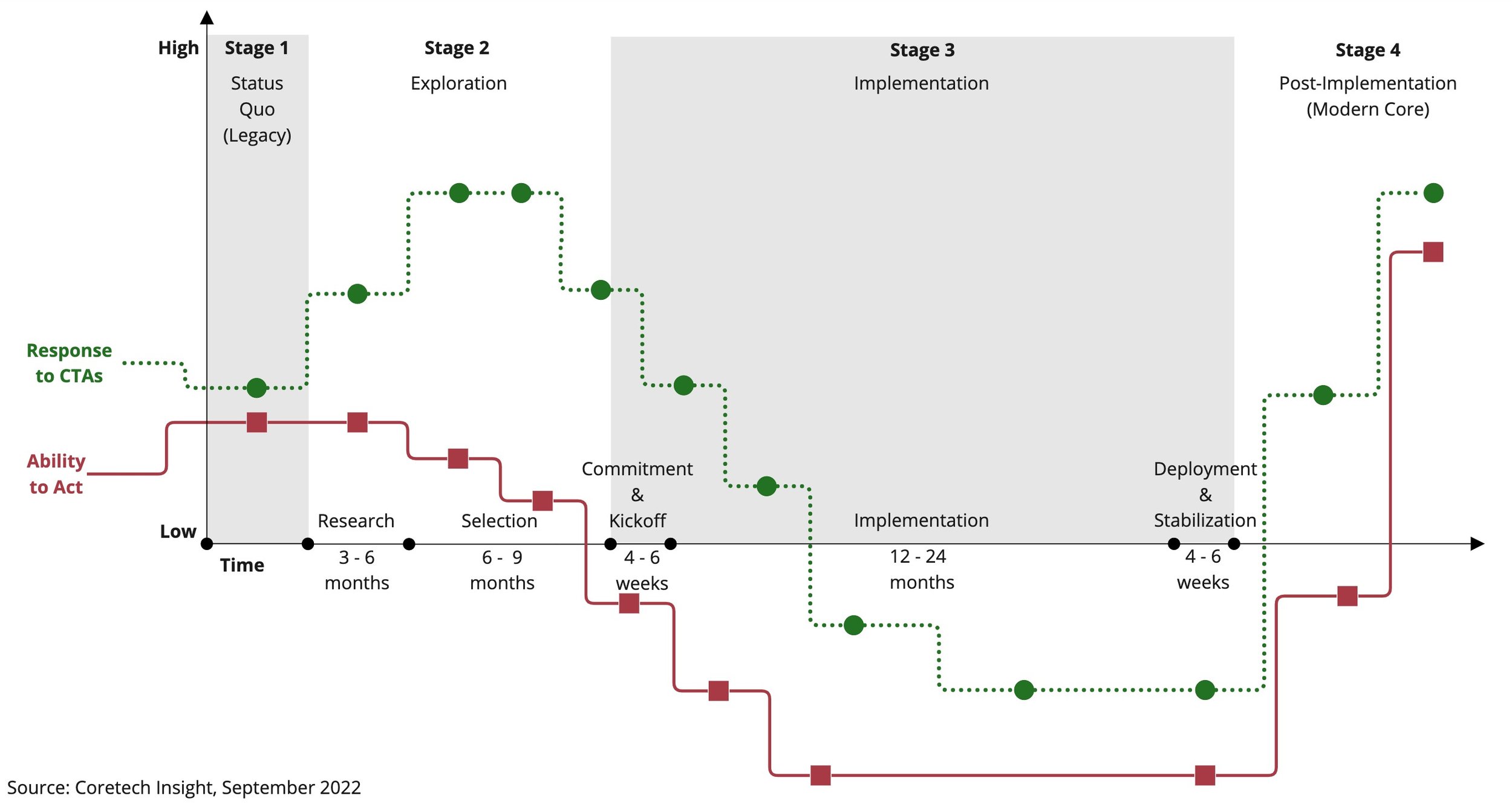

Figure 1 below shows the four stages of modernization and tracks how an insurer’s responsiveness and ability to act change with each stage.

Figure 1. Four Modernization Stages

1. Status Quo (Legacy)

Insurers in this first stage are bogged down with the common challenges of legacy systems – lack of flexibility, brittle code, and the difficulty (sometimes impossibility!) of accessing data and integrating with third parties. The care and feeding of legacy systems is often so resource-intensive that there is nothing left for new solutions – no time; no resources; no budget. At this stage, responsiveness and ability to act are low. The legacy burdens are so great insurtechs may not have any opportunities for interaction with a stage 1 P&C insurer.

2. Exploration

In this stage, senior leadership at the insurer recognize the need for change. They begin asking about and looking for alternatives to their legacy systems. As they engage with core platform vendors, their tech partners, and other insurtechs, they begin to see what is possible with new platforms, ecosystems, and business models.

This is the stage of the hypothetical insurer in the opening of this article. The future-state possibilities are exciting – much more exciting than their legacy world. Responsiveness climbs as the insurer is quick to engage with new vendors and eager to explore new solutions.

3. Implementation

After exploring options, some insurers choose to address legacy issues incrementally – for example, by carving out and replacing a subset of their systems or deploying a new point solution to address a narrow pain point. Most insurers eventually conclude they will need a new core platform to achieve the future state they envision. This is especially true if their legacy systems are decades old (many still are). Implementing a core platform is a major initiative that is often a “once-in-a-career” undertaking. For some senior leaders, a new core platform can make or break their careers. As the new platform is selected and implementation gets underway, it becomes all-consuming. There is simply no ability to act. Responsiveness plummets as the insurer shelves non-core projects.

For insurtechs and other tech solution providers, it can be a shock to see eager prospects abruptly shift to, “Can we talk in a couple of years?”

4. Post-Implementation (Modern Core)

It may take a year or two for implementation. Coretech Insight’s review of vendor/client press releases found an average of 25 months elapsed from start to initial deployment. Eventually, the new core platform will be fully implemented and ready to support the future-state scenarios that were part of the decision to modernize in the first place.

As insurers enter this post-implementation stage, responsiveness jumps. They reestablish connections with insurtechs and other providers. Their ability to act also rises to new highs as they begin to explore what is now possible with their modern core.

Implications for Insurtechs

After seeing this modernization pattern, insurtech leaders may be tempted to focus all their efforts on P&C insurers that are in or entering stage 4. Insurtechs are under intense pressure to onboard clients and generate revenue. Why not focus marketing and sales on those that are ready to buy – the insurers that have made the jump to a modern core and are ready to add new capabilities?

A Stage 4 focus will help with short-term opportunities, but an insurtech that only focuses only on Stage 4 will miss a much larger, broader opportunity. Another factor must be taken into consideration: level of interest. Figure 2, below, shows the four modernization stages from the earlier Figure 1 and adds “level of interest.” Unlike responsiveness and ability to act, which drop tremendously during implementation, level of interest increases early and remains high throughout stages 2, 3, and 4.

Figure 2. Modernization Stages: Interest, Responsiveness, and Ability to Act

This sustained, high level of interest is key. Even when P&C insurers “go dark” during implementation in Stage 3, there is still a high level of interest in insurtech offerings and their place in the future state the insurer is building. By continuing outreach and providing valuable information, insurtechs position themselves as known and credible solution providers, so the insurer will engage even faster post-implementation.

Rather than focusing only on Stage 4 opportunities, insurtechs should understand which stage each prospect is in and their primary needs at that stage, and adjust to meet these. Table 1, below, covers these stages in greater detail. It shows how the customer’s needs change throughout the stages and how insurtechs can align their goals and approach to meet their needs and build a successful customer relationship.

Table 1. Modernization Stages, Needs, Goals, and Approaches

Core Platform Vendors Offer a Faster Path to Customers

Partnerships with core platform vendors offer insurtechs a faster path to potential customers. Each core platform vendor has a collection of insurer customers that form what could be thought of as a core modernization “assembly line” (see Figure 3, below). The assembly line begins with a large funnel of prospects in the exploration state that are considering the vendor or are new clients, narrows to those insurers that have moved into implementation, and concludes with those insurers that have deployed the platform and are operating with a modern core.

By partnering with a core platform vendor, an insurtech can quickly gain visibility into the status of a group of insurers. The insurtech can then classify and appropriately reach out to insurers that have moved out of the status quo stage and are on their modernization journey moving toward or already using a modern core.

Figure 3. Core Modernization “Assembly Line”

Find the Right Core Platform Partner(s)

Ironically, for an insurtech evaluating potential core platform vendor partners, the initial search criteria will be similar to P&C insurers who want to modernize. Key filters will be supported (LOBs), breadth of platform capabilities, client size & type, customers in production, and vendor employee count. (See Coretech Insight’s article “Five Eval Criteria to Jumpstart Your P&C Coretech Shortlist” for more information on these filters and how to apply them).

Ideally, an insurtech and its core platform vendor partner(s) will share a common ideal customer profile. For example, if an insurtech’s solution is intended for Tier 4/5 insurers writing commercial LOBs, a core platform vendor specializing in Tier 4 mutual insurers with personal and small commercial LOBs will be a good match and likely strong partner. A core platform vendor specializing in personal lines for Tier 1 insurers would be a poor match.

It is critical for an insurtech to verify that potential core platform partners have strong sales execution. Some core platform vendors boast of a large number of customers but rarely onboard new customer logos. They generate revenues from subscriptions and professional services to their existing customers. Their lack of sales execution is a red flag – this can be a sign that, in the minds of the customers and the broader market, the vendor is a legacy system provider. Instead of Stage 4, the customers may see themselves in Stage 1 or 2, and be preparing for a move to another vendor with a new core.

Be a Good Partner

After an insurtech has identified core platform vendor partners, it will need to invest in these relationships to build strong, mutually beneficial partnerships. Core platform providers are routinely approached by technology solution providers, insurtechs, and third-party services with unrealistic expectations — such as assuming the core platform vendor will cover the cost of integrations, expecting immediate access to the vendor’s customer base, and even expecting the core platform to promote the new solution to their customers.

Instead of immediately making moves to exploit new relationships with core platform vendors, insurtechs should take time to understand and follow the partner onboarding and certification process. They should be prepared to cover the cost of integrations and other work needed to establish the partnership. (Insurtechs raising funds from investors should include funding for partnerships and integrations in their proposals.) Adhering to the vendor’s policies and guidelines for engaging with their customer base is also critical. The trust and credibility insurtechs establish by building a strong relationship with the core platform vendor will carry over and improve their standing and ability to engage with the customer community.

Bottom Line

It can be disheartening for an insurtech to hear, “See you in a couple of years, we’re going to implement a new core platform,” but this is actually common and a reflection of broader modernization trends. Even when an insurer “goes dark” during a core implementation, interest levels in insurtech capabilities will remain high. By continuing outreach, but shifting the focus/approach to match insurers’ needs at each modernization stage, an insurtech can build trust and credibility. Core platform vendors provide insurtechs with a faster path to groups of insurers. By selecting suitable core platform vendor partners — and being good partners themselves — insurtechs can more quickly find and close deals with insurers who have already made the leap to new core platforms, and begin reaching out to those that are mid-implementation to set the stage for future opportunities.

About the Authors

Phil Reynolds founded the P&C core platform vendor BriteCore in 2009, and continues to serve as chairman of BriteCore’s board of directors.

In 2021, Phil co-founded DevStride* with agile practitioners and technology leaders, Kujtim Hoxha, Aaron Saloff, and Chastin Reynolds. Agile teams have a need to keep work aligned with shifting business priorities. Leaders have the challenge of understanding the true state of the work. Phil and his co-founders have lived these challenges and understand the need for clarity that other tools have been missing. They built a solution that aligns strategy and execution, reduces fragmentation, and improves delivery assurance. DevStrides provides immediate answers to complex questions…so that agile organizations have a clear path to better outcomes.

Tired of guessing, failing, and losing time to rework?

Contact Phil at phil@devstride.com

*As seen in Disrupt Magazine, Business Insider, and Kansas City Business Journal

Jeff Haner is the founder of Coretech Insight, an independent advisory firm.

Coretech Insight serves P&C insurers and coretech providers who want to find customers and partners they can be wildly successful with. The firm provides research, frameworks, and insights to bring ideal customers and vendor partners together.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience as a customer, analyst, and vendor provides a unique perspective that cuts through the noise and finds ideal matches between insurers and coretech solution providers.

Are you an insurer looking for a reliable guide to core systems? Are you a coretech or insurtech vendor trying to connect with your ideal customers?

Contact Jeff at jeff.haner@coretechinsight.com