Ecosystems as Strategic Signal: Five Types of Coretech Ecosystems

In this mature market, where differentiation is a challenge, a coretech vendor’s ecosystem provides important insight into its product capabilities, future direction, and long-term viability.

In Q4 2025, Coretech Insight reviewed 39 ecosystems with over 600 partners, and defined five types of coretech ecosystems that cater to different buyer needs.

This article covers our findings and provides recommendations for buyers and vendors on how to use ecosystem type as a strategic signal to inform their coretech decisions.

A P&C insurance coretech ecosystem develops over time. It reflects a vendor’s history, vision, partnerships, and go-to-market strategy. Unlike other capabilities that are common and can seem indistinguishable in this mature market, an ecosystem reveals a unique fingerprint for each vendor. For buyers, partners, and investors, it can signal:

Strength of the underlying platform/system(s)

Strategic focus and areas of expertise

Implementation speed

Ease of integration

Long-term viability

The strength of an ecosystem was once a secondary consideration during core platform selection. Today, it is a key decision factor. A modern, flexible core platform with a well-cultivated ecosystem offers insurers a fast track to essential data, functionality, technology, and services. A core platform with a limited ecosystem, or with design limitations that stunt ecosystem growth, is a liability. In the minds of many buyers, the ecosystem is the platform.

This article presents initial findings from our research into coretech ecosystems in North America. The broader study includes:

Review of 39 coretech ecosystems

Evaluation of vendor ecosystem messaging and press releases

Development of an ecosystem marketplace maturity model

Review of over 600 ecosystem partners

Mapping of ecosystem partners to over 30 partner categories and over 100 subcategories

Identification of dominant categories and dominant ecosystem partners

The Five Types of Coretech Ecosystems

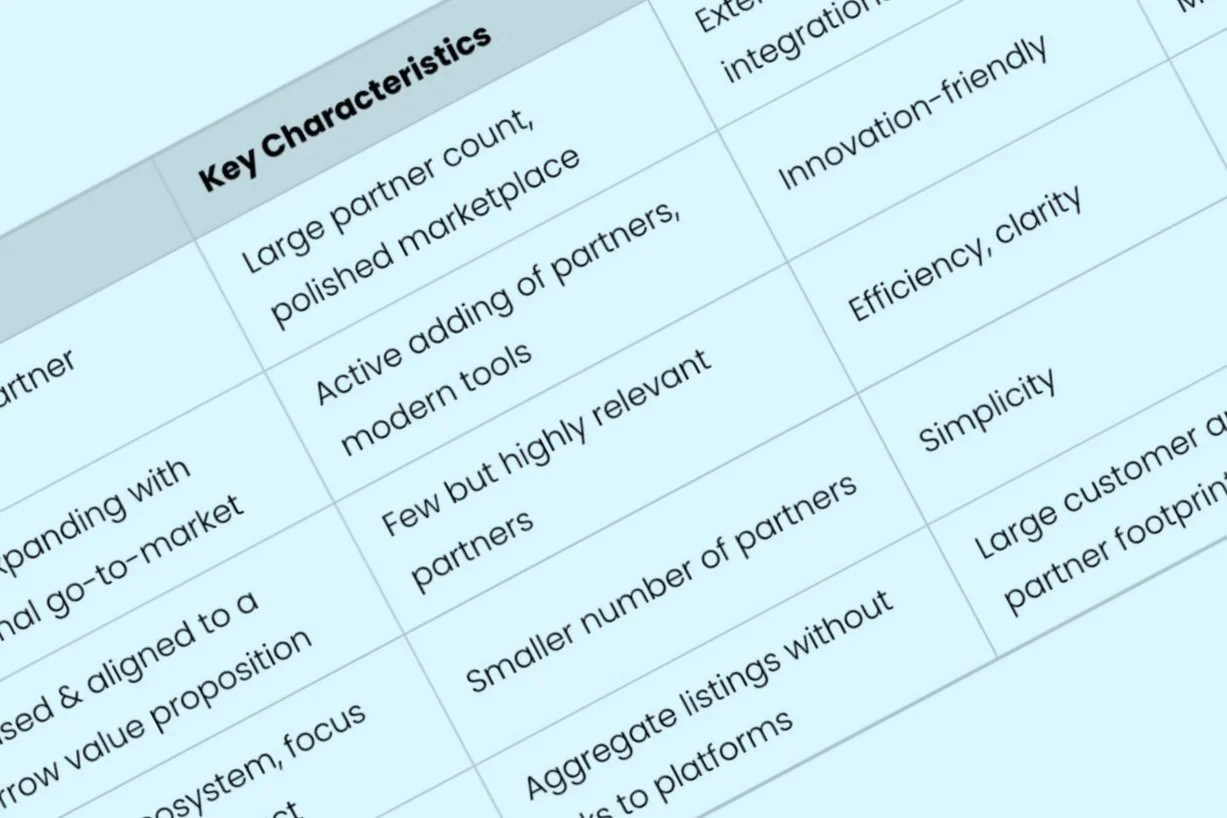

The coretech ecosystems in our review included partners that, on average, covered 11 of 30 partner categories, or 37% coverage. Across the 39 ecosystems, there are clear differences in breadth and focus. We employed a weighted scoring model to assess ecosystem positioning, maturity, and partner composition, and identified five distinct ecosystem types, as summarized below in Table 1.

Table 1. Five Types of Coretech Ecosystems

| Category | Definition | Key Characteristics | Strengths | Weaknesses |

|---|---|---|---|---|

| Industry Marketplace Ecosystems | Broad, deep partner ecosystems | Large partner count, polished marketplace | Extensibility, integrations | Complexity, partner curation burden |

| Expansion-Stage Ecosystems | Rapidly expanding with intentional go-to-market | Active adding of partners, modern tools | Innovation-friendly | Less depth than Industry Marketplace Ecosystems |

| Specialized Ecosystems | Focused & aligned to a narrow value proposition | Few but highly relevant partners | Efficiency, clarity | Limited breadth |

| Product-Centric Ecosystems | Minimal ecosystem, focus on internal product | Smaller number of partners | Simplicity | Long-term viability concerns |

| Multi-Platform Ecosystems | Acquired platforms, fragmented ecosystems | Aggregate listings without links to platforms | Large customer and partner footprint | Technical debt, inconsistent experience |

Source: Coretech Insight, December 2025

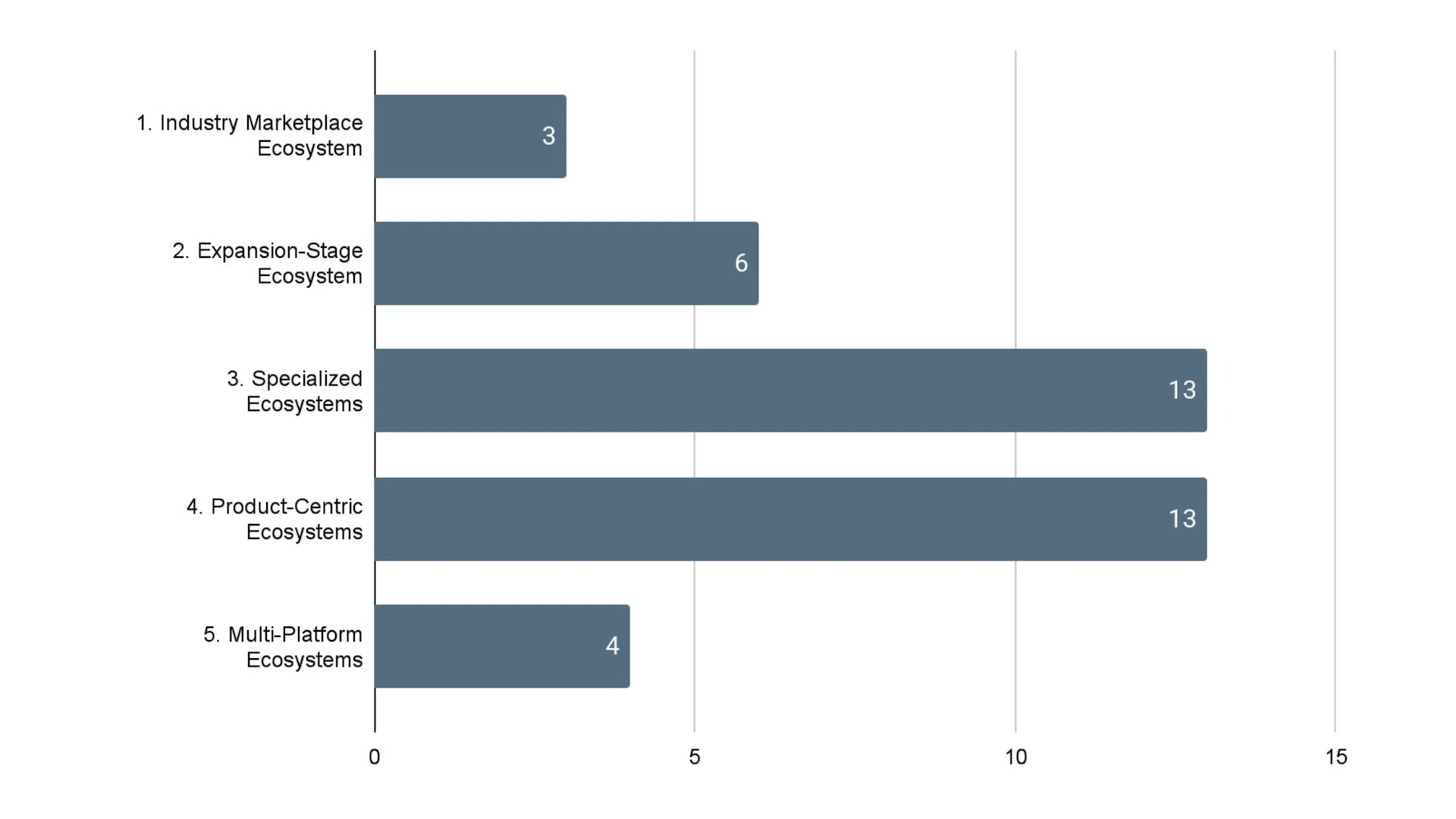

Figure 1 below shows the distribution of ecosystem types across the 39 coretech vendors. Two-thirds of coretech vendors are evenly split between 13 Specialized Ecosystems and 13 Product-Centric Ecosystems. A subset of six vendors is in an expansion stage, more rapidly building out their ecosystems. Three vendors have grown their ecosystems to industry-scale marketplaces. Lastly, four vendors with a history of more aggressive M&A activity operate Multi-Platform Ecosystems.

Figure 1. Distribution of Coretech Ecosystem Types

Source: Coretech Insight, December 2025

Note: This analysis is based on publicly available data, which does not provide complete visibility into vendor ecosystem capabilities. Some vendors may maintain partnerships not publicly disclosed. Our findings reflect comparative patterns across the industry. Please see Note 1. Methodology below for a full description of our research methodology.

1. Industry Marketplace Ecosystems

Pattern:

Horizontal Completeness

Industry Marketplace Ecosystems are large, comprehensive, and formalized. These ecosystems span nearly all partner categories, and offer choice and redundancy, with multiple partners per category. They show notable strength in AI & automation, BI & analytics, application development & DevOps, and collaboration & productivity categories. With their expansive breadth and depth, they are a microcosm of the P&C insurance industry.

Within Industry Marketplace Ecosystems, partners are central to the platform’s architecture, go-to-market strategy, and customer delivery model. These coretech vendors are market leaders, attracting new partners and customers due to market dominance and the large size and diversity of their established customer bases.

Publicly, Industry Marketplace Ecosystems present polished marketplace portals with structured categories, filtering, and informative profiles for partners and their solutions. Partners have been vetted, and their solutions have undergone a review/certification process. These marketplace portals offer customers a high degree of self-service, with many “apps” or partner offerings accessible via downloads or user-accessible configuration panels. Co-marketing, joint implementations, and partner participation with multiple solutions all reflect the maturity of these ecosystems.

The primary strength of Industry Marketplace Ecosystems is extensibility. Buyers gain access to a broad range of prebuilt and pre-integrated capabilities and innovation paths. These ecosystems are well-suited to large, complex enterprise environments with diverse products and services. However, the breadth of capabilities increases complexity and cost. Buyers must navigate a large and growing number of choices, and vendors must actively curate and govern partners to ensure quality and continued relevance.

An Industry Marketplace Ecosystem shows that a vendor is competing as a platform business, with ecosystem breadth and depth reflecting long-term investment, architectural openness, and an expansive, future-oriented mindset.

2. Expansion-Stage Ecosystems

Pattern:

Forward-Looking Innovation

Expansion-Stage Ecosystems reflect vendors that are actively building out their partner environments, but have not yet reached the scale of Industry Marketplace Ecosystems. These coretech vendors built support for ecosystems into their platforms from the earliest stages, with modern API-first and cloud-native architectures. They have stronger coverage of innovative capabilities, such as AI-driven automation, integration layers & APIs, and digital experience. However, their coverage of some long-standing capabilities, for example, inspections and claims litigation, is less consistent.

Partner counts for Expansion-Stage Ecosystems are smaller than those of Industry Marketplace Ecosystems; however, Expansion-Stage Ecosystems often demonstrate high maturity and technical prowess relative to their size. Integrations are intentional and focused on high-value use cases rather than broad coverage.

Expansion-Stage Ecosystems offer structured partner directories, with categories, filters, and consistency in how ecosystem partners and their solutions are positioned. Some may offer self-serve portals similar to Industry Marketplace Ecosystems, albeit with a smaller number of partners. These vendors explicitly communicate their ecosystem strategy, signaling transparency and their long-term intent to cultivate stronger ecosystem capabilities.

Agility is the strength of Expansion-Stage Ecosystems. They enable faster partner onboarding and alignment with emerging technologies and digital business models. However, they lack the breadth and depth of Industry Marketplace Ecosystems. Some partner categories may be sparsely represented, or not represented at all, which may require buyers to shore up gaps with custom integrations.

An Expansion-Stage Ecosystem shows momentum and a strategic focus on ecosystem development. It reflects a vendor investing in ecosystem maturity ahead of, or alongside, customer growth. Expansion-Stage Ecosystems favor forward-looking capabilities over legacy domains.

3. Specialized Ecosystems

Pattern:

Vertical Depth

Specialized Ecosystems are focused on a specific functional area, line of business, or operating model. Rather than maximizing breadth, these ecosystems prioritize relevance, efficiency, and alignment with customer needs. They tend to offer capabilities concentrated on claims management, policy administration, or more specialized lines of business, such as workers’ compensation, along with a narrower band of data capabilities for their target market.

Specialized Ecosystems have fewer and a more focused number of partners, shaped by core product focus and customer demand. Marketplace messaging and promotion is more limited. Ecosystem presentation is simpler, with partners and solutions often listed on a landing page that may be grouped into categories.

Clarity is the strength of Specialized Ecosystems. Buyers within the target segment benefit from highly relevant partners closely matched to their requirements. Integration overhead is typically lower, and ecosystem complexity is minimized.

The trade-off is flexibility. Specialized Ecosystems may struggle to adapt if customer needs expand or if adjacent capabilities grow in importance. For buyers seeking many options or long-term extensibility, the narrower scope of these ecosystems may become a constraint.

A Specialized Ecosystem reflects a disciplined focus on customer demand within a defined operational scope, rather than an ambition to support industry-wide digital transformation. These ecosystems optimize for efficiency and relevance over optionality.

4. Product-Centric Ecosystems

Pattern:

Reactive Coverage

Product-Centric Ecosystems exist as an outgrowth of a vendor’s core product. These ecosystems have narrower breadth and less visibility, as the vendor places less emphasis on promoting an ecosystem narrative. For vendors operating Product-Centric Ecosystems, core product capabilities remain their primary source of differentiation, while partner integrations play a secondary role. Their partial coverage of partner capabilities varies widely.

Product-Centric Ecosystem integrations are driven by customer needs and near-term market opportunities, rather than a coordinated ecosystem strategy. Public partner listings offer limited information – often a simple list or scroll of partner logos – with few details and no distinction between ecosystem partners and their solutions.

The simplicity of Product-Centric Ecosystems has advantages for well-defined and established market segments. Buyers benefit from clear product ownership and reduced coordination overhead. For insurers operating in stable or niche markets, Product-Centric Ecosystems offer simpler access to mainstream capabilities and may provide better value than larger, more complex ecosystems.

However, as buyer expectations rise, Product-Centric Ecosystems may fall short. Limited access to external innovation may constrain adaptability. A narrow set of partners and basic ecosystem presentation may raise concerns among customers and prospective buyers about the vendor’s vision and long-term viability.

A Product-Centric Ecosystem indicates a niche-player orientation, with emphasis on core platform/solution development rather than extensibility through ecosystem partners. Product-Centric Ecosystems tend to integrate technologies as needed, rather than cultivating them as part of a broader platform strategy.

5. Multi-Platform Ecosystems

Pattern:

Uneven Density

Multi-Platform Ecosystems are characterized by diverse collections of platforms, products, architectures, and deployment models. These ecosystems often result from acquisition-driven growth. They are strong in professional & technology service capabilities and legacy-heavy domains, but tend to be less consistent in AI, automation, and dev tooling. Multi-Platform Ecosystems may have a broad set of ecosystem partners in aggregate, but partner availability can vary significantly, as each ecosystem partner may support only a specific platform or module within the vendor’s solution portfolio.

Public signs of Multi-Platform Ecosystems include multiple partner listings or portals, inconsistent categorization, and uneven ecosystem promotion. The vendor may provide only limited information about its full product portfolio and ecosystem partners on its website and marketing materials. Buyers who fail to research the history of the vendor’s product development and M&A activity may underestimate the degree of fragmentation and inconsistent coverage.

The strength of Multi-Platform Ecosystems lies in reach. These coretech vendors often support diverse markets and operating models, including niche segments that fall outside the mainstream. The primary constraint is clarity: inconsistency across product offerings increases integration risk and reduces the predictability of partner experience.

A Multi-Platform Ecosystem reflects scale and breadth in aggregate, but also architectural and organizational complexity. Ecosystem value must be evaluated at the individual platform or solution level, not the vendor brand level.

How to Use Ecosystem Type as a Strategic Signal

Ecosystem type is not a scorecard for vendor quality. Each ecosystem reflects a set of capabilities and trade-offs shaped by architecture, history, and market focus. The suitability of a coretech ecosystem depends on how well its underlying platform and partner coverage align with the customer's needs. The value of this framework lies in its ability to help stakeholders interpret what an ecosystem reveals about a coretech vendor’s platform capabilities and its future direction.

The following recommendations outline how to use ecosystem type to make more informed coretech decisions.

Recommendations for Buyers

Favor ecosystem types that match your organizational vision and readiness. Industry Marketplace Ecosystems reward buyers with more expansive strategic goals, formal integration governance, and vendor management discipline. Expansion-Stage Ecosystems and Specialized Ecosystems may be better suited to organizations that prioritize agility, innovation, or rapid modernization. Product-Centric Ecosystems can be effective and deliver the highest business value when requirements are stable and well-defined.

Look beyond lists of partner names and logos; probe and evaluate integration reality. Public logo listings fail to convey differences in integration depth, ease of deployment, and ongoing support. Probing how vendors deploy, maintain, and support partner integrations will provide more insight than partner counts alone.

Use ecosystem type and maturity as an indicator of long-term viability. Platforms with intentional, well-articulated, and dynamically evolving ecosystems are better positioned to adapt to industry changes and emerging technologies. Static or fragmented ecosystems may introduce capability gaps and increase future customization, integration, or switching costs.

Recommendations for Coretech Vendors

Clearly articulate your ecosystem strategy and how it serves the needs of your customers. Specificity builds credibility, communicates business value, and sets appropriate expectations. A lack of an ecosystem strategy is a red flag for buyers; generic claims of openness or breadth provide no differentiation.

Align your marketplace presentation with ecosystem reality; ensure partner and solution profiles are current and informative. Underdeveloped, inconsistent, and out-of-date partner listings undercut ecosystem messaging, confuse and frustrate prospective buyers, and weaken your competitive positioning.

Align your ecosystem goals with your desired ecosystem type. Industry Marketplace Ecosystems should prioritize partner quality, governance, and clarity. Expansion-Stage Ecosystems benefit from clear rubrics for prioritizing new partner opportunities and repeatable partner onboarding processes. Specialized Ecosystems and Product-Centric Ecosystems gain more by emphasizing precision and relevance in partner selection and management than broad partner accumulation.

Recommendations for Ecosystem Partners (Insurtechs & Service Providers)

Favor vendors that have articulated an ecosystem strategy and a clear presentation of their ecosystem partners. A lack of information about ecosystem strategy, partners, and solutions can indicate a limited product vision, potential integration challenges, and higher vendor viability risk.

Target coretech ecosystems based on market fit and opportunity. Industry Marketplace Ecosystems offer numbers and greater potential reach, but competition for attention and resources is high. You may achieve faster access to new opportunities by choosing other ecosystem types with core platforms and partners that better complement your offerings, even if they have a smaller number of partners and customers.

Tailor your partner management approach to the ecosystem type. Industry Marketplace Ecosystems often require admittance to formal partner programs, greater up-front investment, and longer ramp-up times – be prepared for the level of investment and attention these ecosystems require. Coretech platform vendors running smaller, more focused ecosystems often operate less formally, have fewer onboarding requirements, and may move faster and be more willing to partner on joint marketing and sales initiatives.

In a mature market, where it can seem that every vendor is offering the same coretech solutions, ecosystems provide buyers, partners, and investors with a distinct and invaluable signal of vendor capability and long-term viability. It requires dedicated time and effort for a coretech vendor to articulate an ecosystem strategy, onboard new partners, present partners coherently, and provide customers with ready access to these solutions. Cultivating a healthy ecosystem cannot be done overnight. The progress a coretech vendor has made in its ecosystem journey is an excellent proxy for its overall health.

For readers seeking a deeper view of the state of coretech ecosystems — including comparative assessments, partner category coverage, and vendor and core platform-specific insights — Coretech Insight offers private research reports and executive briefings. These are tailored to buyers, vendors, and ecosystem partners.

Readers interested in private reports or executive briefings are invited to contact Coretech Insight at jeff.haner@coretechinsight.com.

Note 1. Methodology

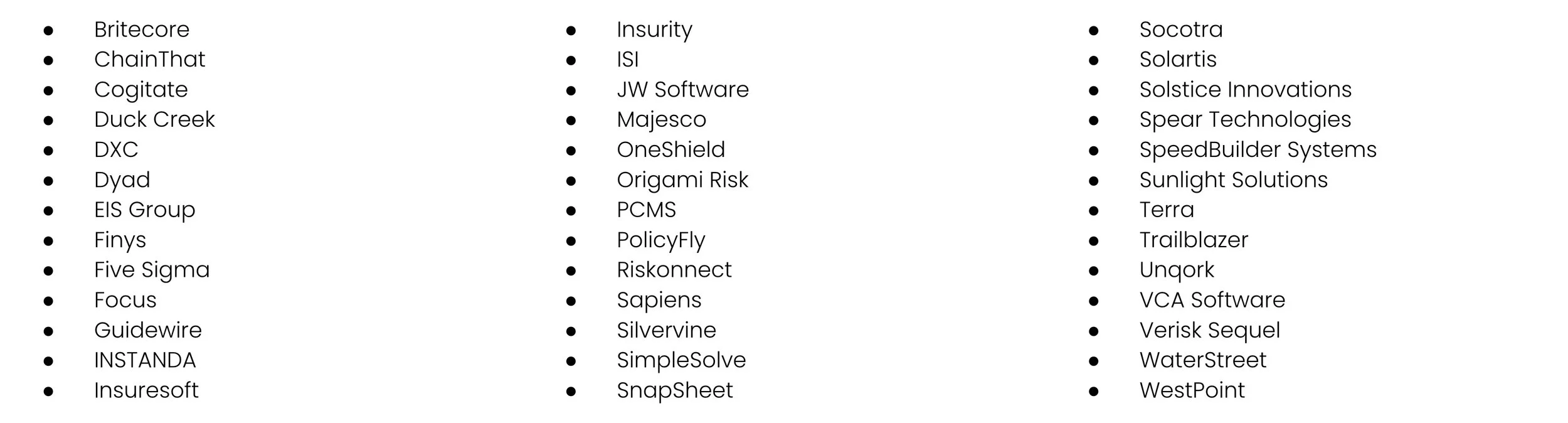

This article is based on an analysis of P&C core platform ecosystems conducted by Coretech Insight in Q4 2025. This research is designed to identify and compare ecosystem patterns, not to audit integration capabilities or actual production usage.

For this research, we reviewed publicly available ecosystem, partner, and/or marketplace content for the following 39 coretech vendors:

We also gathered 450+ press releases from these vendors that covered technology partner announcements over the last decade and a half.

From these reviews, we catalogued over 600 ecosystem partners and mapped these to 30 categories and over 100 subcategories. We also cross-referenced our ecosystem findings with our data on over 1,800 customers (primarily carriers and MGAs) publicly announced by these coretech vendors.

We then assessed and scored each vendor’s ecosystem based on:

Ecosystem marketplace enablement and presentation

Ecosystem positioning and messaging

The number of ecosystem partners

Ecosystem partner coverage of capability domains

The number of publicly announced customers

This assessment resulted in the five categories of ecosystems described in detail in the article:

Industry Marketplace Ecosystems

Expansion-Stage Ecosystems

Specialized Ecosystems

Product-Centric Ecosystems

Multi-Platform Ecosystems

While this information and the resulting findings provide valuable insight into coretech ecosystems, important caveats apply:

Public ecosystem presentations may not represent the full depth of an ecosystem. Some vendors maintain extensive integration libraries and partner relationships that are not shared publicly.

Public listings vary widely in effort and presentation. Some vendors have polished, self-serve marketplaces with rich metadata; others share simple logo grids, static partner lists, or have no public ecosystem presentation at all. Limited public listings may reflect a deficit in marketing and product strategy, not a lack of integrations.

Public partner counts are only one dimension of ecosystem maturity. They do not capture integration depth, frequency of deployment, or usage in production.

Despite these limitations, publicly shared ecosystem content provides a valuable signal that helps reveal how vendors position themselves, which partners they prioritize, their investment in extensibility, and the role of ecosystems in their product strategy.

Jeff Haner is the co-founder of Coretech Insight, an independent advisory firm.

For growth-stage insurance tech providers – from innovative coretechs to rising insurtechs – who need to stand out in a crowded market and accelerate customer acquisition, Coretech Insight provides product strategy and go-to-market services that capture the attention of buyers and speed up sales.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner, he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience “on both sides” of the insurance technology table and his ongoing research enable him to offer deep insurance industry knowledge, strategic insights, and hands-on help to take action.

Contact Jeff at jeff.haner@coretechinsight.com