Early Indicators: Coretech Trends Toward New Products & Startups

How did 2022 P&C core platform buying activity compare to prior years?

This is an update to our 11/23/22 article on public coretech deals. Our findings below incorporate press releases through the end of 2022.

We reviewed 262 press releases announcing new core platform selections from 1/1/2015 through 12/31/2022. While there were fewer deals, 2022 saw a continuation of earlier trends with shifts in buyers, objectives, market leaders, and platform types.

Overview

With 2022 behind us, we have a full year of public data on P&C core platform selections available to inform key questions:

How did buying activity for P&C core platforms compare with prior years?

Are we “back to normal” after the pandemic, or have there been changes?

What will buyer priorities look like in 2023?

To address these questions, Coretech Insight identified and reviewed 262 vendor and insurer press releases for P&C core platform selections in the US and Canada from 2022 and the prior seven years.

Analysis

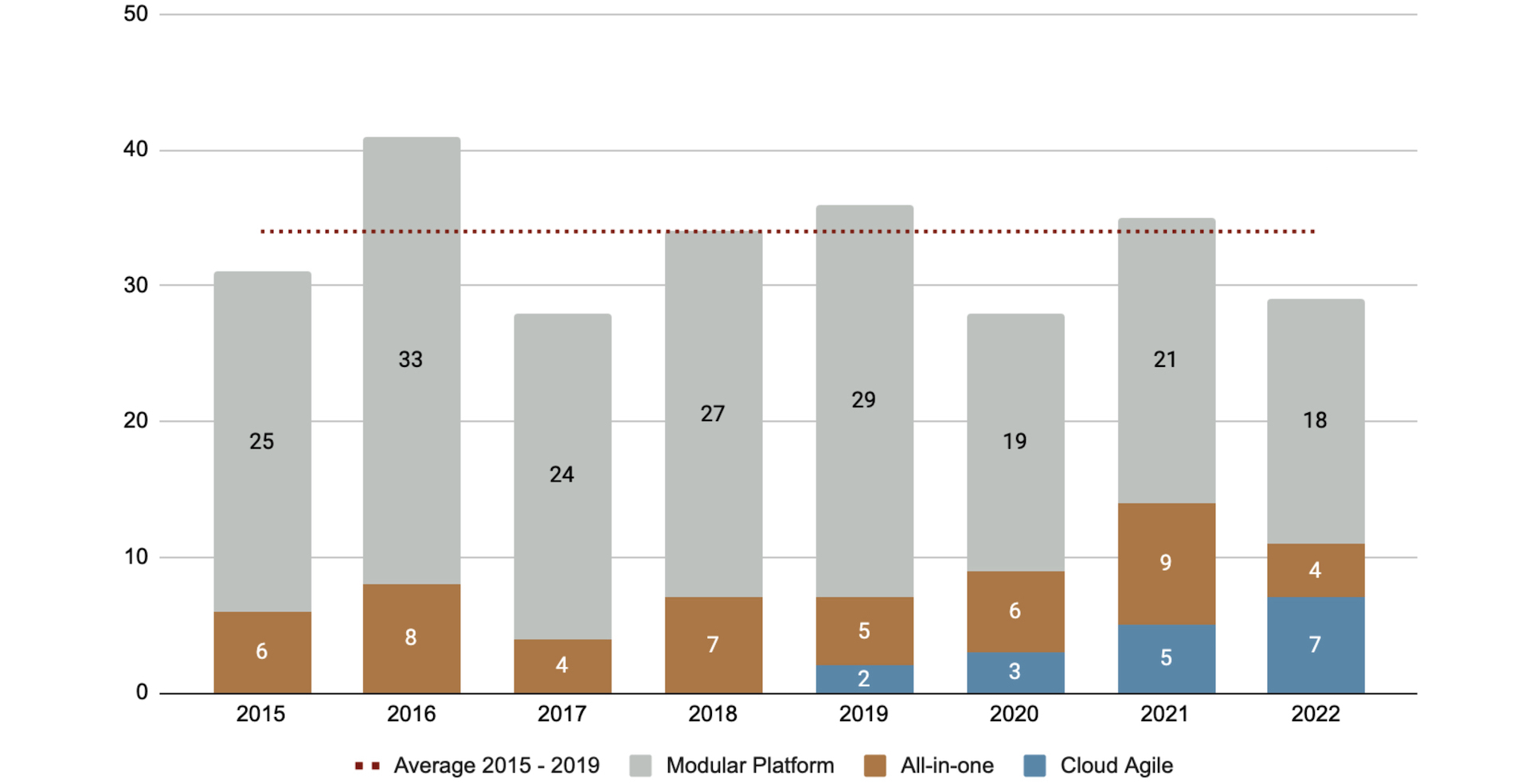

Figure 1 below plots the annual totals for core platform selection announcements. These range from 28 to 41 announcements per year over the past eight years. While there was a drop in 2020 during the early period of the pandemic, total deals were similar to other years with a lower number of announcements, such as 2017. Using the average total from 2015 through 2019 as a benchmark (five “normal” years before 2020) we see that by 2021 the number of selections had returned to a normal range.

Figure 1. Public P&C Core Platform Selections 2015 - 2022

Source: Coretech Insight, January 2023

Total public deals were lower in 2022 – 17% lower than 2021. Figure 2 below plots monthly results for 2022 against monthly highs, lows, and averages from 2015 - 2019. Results were stronger early in the year, but there were a few months from June through the end of 2022 with a lower-than-average number of public selections and one month (November) with zero announcements.

Figure 2. Monthly P&C Core Platform Selections

Source: Coretech Insight, January 2023

These results show some weakness in demand and a quieter end to 2022 in terms of public deals, but a continued appetite for new P&C core platforms that is consistent with prior years.

There’s more to this story, though – looking past the annual totals to the composition of these deals, we find the nature of these new platform selections is changing. Figures 3 through 6 below show the following key changes:

The percentage of new selections from startups grew from almost zero in the years 2015 - 2017 to nearly 30% of new deals in 2022. (See Figure 3.)

The percentage of new selections from MGAs/MGUs has also grown from a small minority to over 30% of new deals in 2022. (See Figure 4.)

Along with the focus on startups, over the past three years there was an increase in selections for new products or greenfield implementations, and a decrease in the percentage of new announcements for legacy modernization. (See Figure 5.)

This emphasis on start-ups and new products favors the speed and flexibility offered by cloud agile platforms, which grew to nearly a quarter of new public deals in 2022. (See Figure 6.)

Figure 3. P&C Core Platform Selections by Premium Tier

Source: Coretech Insight, January 2023

Figure 4. P&C Core Platform Selections by Insurer Type

Source: Coretech Insight, January 2023

Figure 5. P&C Core Platform Selections by Deployment Objective

Source: Coretech Insight, January 2023

Figure 6. P&C Core Platform Selections by Solution Type

Source: Coretech Insight, January 2023

These changes are also driving new market leaders depending on the deployment objective. Tables 1 and 2 below show how different leaders emerge when the objective for a new platform selection is legacy modernization vs. new products or startups.

Table 1. P&C Core Platform Selections for Legacy Modernization*

Source: Coretech Insight, January 2023

Table 2. P&C Core Platform Selections for New Products, Greenfields, and Startups*

Source: Coretech Insight, January 2023

2022 also saw public deals concentrated among a smaller number of vendor platforms (nine platforms in 2022 vs 15 different platforms in 2021). Table 3 below shows how, within these nine platforms, there were two distinct groups – platforms from Guidewire (InsuranceSuite), Origami Risk, and Duck Creek that were selected by larger insurers and almost exclusively in support of legacy modernization, and platforms from the other half dozen vendors – Cogitate, Guidewire (InsuranceNow), ISI, Socotra, INSTANDA, and Insurity – that were selected by startups and smaller, Tier 5 and Tier 6 insurers.

Table 3. 2022 P&C Core Platform Selections by Tier & Platform

Source: Coretech Insight, January 2023

Implications

Although weaker in the second half of 2022, demand for P&C core platforms is steady and consistent with prior years. Changes in buyer size, type, and focus, though, have implications for both buyers and sellers.

For buyers with legacy modernization initiatives:

Buyers focused on legacy modernization will be among a smaller pool of opportunities. Vendors view legacy modernization initiatives as desirable because they are larger in scope, more predictable, and more profitable than new product and startup implementations. Buyers will enjoy more flexible terms and more negotiating power. Increased competition will put financial pressure on weaker vendors, so verifying vendor viability should remain a key aspect of selection.

For vendors seeking legacy modernization opportunities:

To cut through the noise of increased competition, vendors focusing on legacy modernization must have crisp messaging about the customers they are best suited to serve, the problems they solve, and the path they provide to business value. These shifts toward new products / startups in part reflect a weariness among buyers with vague assertions about the value of legacy modernization. Buyers desire to quickly realize quantifiable (and compelling) business value.

For buyers with startups or new product/greenfield initiatives:

Buyers with startups, new products, and/or greenfield deployments will also see more engagement from vendors and enjoy more flexible terms. Some vendors, squeezed out of legacy modernization by stronger competitors, will out of necessity shift their focus to new products and startups. Their platforms, though, may not be suitable for demanding and unique requirements. In addition to verifying vendor viability, it will remain important for buyers to confirm solution capabilities — especially flexible product configuration and ease of integration — and verify a vendor’s prior success with new products and startups.

For vendors seeking startup or new product/greenfield opportunities:

Given these trends, every vendor must demonstrate support for new products and startups. However, vendors with a history of supporting legacy modernization with traditional insurers should be selective with startups or new product opportunities. These opportunities often have highly aggressive deadlines (driven by funding or regulations) and unusual requirements. When there is a poor match between requirements and platform capabilities, this can drive excessive custom development, reduce (or eliminate!) profit, and increase the risk of project failure.

The overall picture that emerges from this review is that of a buyers’ market with increased competition among vendors. Vendors need to both demonstrate their ability to support new products and startups, and secure their share of more lucrative legacy modernization opportunities. Those who succeed in only one of these categories will face future growth constraints. Vendors who only succeed with traditional legacy modernization run the risk of being perceived as “new legacy,” with a limited future. Vendors who only succeed with startups and new products will generate less revenue to fund their development and run the risk of being unable to scale. The key is to demonstrate both – the flexibility to support innovative start-ups and new products, and the scale, competence, and resources for successful legacy modernization.

A Note on Methodology

From October 2022 to early January 2023, we identified and reviewed 371 press releases (PRs) from P&C core platform vendors announcing the selection or go-live deployment of their platform or at least one core module (policy, billing, or claims) by US or Canadian customers. These PRs were published from 1/1/2015 through 12/31/2022 and featured on vendor websites and/or reported on by various wire services and news sites such as Business Wire, GlobeNewswire, PR Newswire, Insurance Innovation Reporter, and PropertyCasualty360.

(Sharp-eyed readers will note minor differences in prior year data in these findings vs. our earlier 11/23/22 article. For example, we reported total selection announcements for 2020 at 25 in November, vs. 28 in this article. During the course of our review in December and early January, nine additional PRs from prior years were identified and incorporated into our analysis. These additions did not impact overall trends or conclusions.)

Our objective was to use these PRs to track buying activity and trends among insurance carriers and MGAs/MGUs. From the initial set of PRs we excluded:

57 PRs on go-lives that had no information on the timing of vendor selection

52 PRs on customers that were not P&C insurance carriers or MGAs/MGUs (such as life insurers, TPAs, self-insureds, and government entities)

After these exclusions, 262 PRs covering 36 platforms from 28 vendors remained. Each PR included sufficient information to determine the timing of platform selection and track customer characteristics such as size, type, and deployment objective.

This review did not evaluate implementation timeframes or success rates — its focus was on the number and characteristics of selection decisions announced via press releases to gauge market activity and buying trends.

Jeff Haner is the founder of Coretech Insight, an independent advisory firm.

Coretech Insight provides research, frameworks, and insights focused on matching P&C insurers with ideal coretech providers so that, together, they can be wildly successful.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience as a customer, analyst, and vendor provides a unique perspective that cuts through the noise and finds ideal matches between insurers and coretech solution providers.

Are you an insurer looking for a reliable guide to core systems?

Are you a coretech or insurtech vendor trying to connect with your ideal customers?

Contact Jeff at jeff.haner@coretechinsight.com