2022 P&C Coretech Selections Trend Toward New Products and Startups

How did 2022 P&C core platform buying activity compare to prior years?

We reviewed 251 press releases announcing new platform selections from 2015 through 10/31/2022. Market activity has rebounded from 2020. However, there have been shifts in buyers, objectives, and the types of platforms they are selecting.

Overview

As we wrap up the final quarter in 2022, insurers are assessing the business climate, scanning for opportunities and threats ahead in 2023, and making decisions about investments in technology. Coretech vendors are assessing the market and working to position themselves to address shifting buyer priorities for the new year. During this period of assessment, recalibration, and planning, crucial questions naturally arise:

How did buying activity for P&C core platforms in 2022 compare with prior years?

Are we “back to normal” after the pandemic, or have there been changes?

What will buyer priorities look like in the new year?

To address these questions, Coretech Insight identified and reviewed press releases from the first 10 months of 2022 announcing new P&C core platform selections in the US and Canada. We then extended our review to the prior seven years. In total, we identified and reviewed 251 press releases from 2015 through 10/31/2022 announcing new core platform selections by carriers or MGAs/MGUs from 33 vendors.

These public announcements do not reflect all new system selections during this time period. For various reasons, such as client confidentiality, a conservative approach to promotion, or even a lack of marketing resources, vendors often do not publicize new client wins. We estimate these press releases cover 30 to 40% of all new P&C core platform selections from P&C insurance carriers or MGAs/MGUs during these years.

Although not a complete record of all deals, these announcements are valuable because they provide a public, verifiable record with details jointly approved by buyers and sellers. They represent a high-quality (and consistent) sample of activity in the P&C core platform market.

Analysis

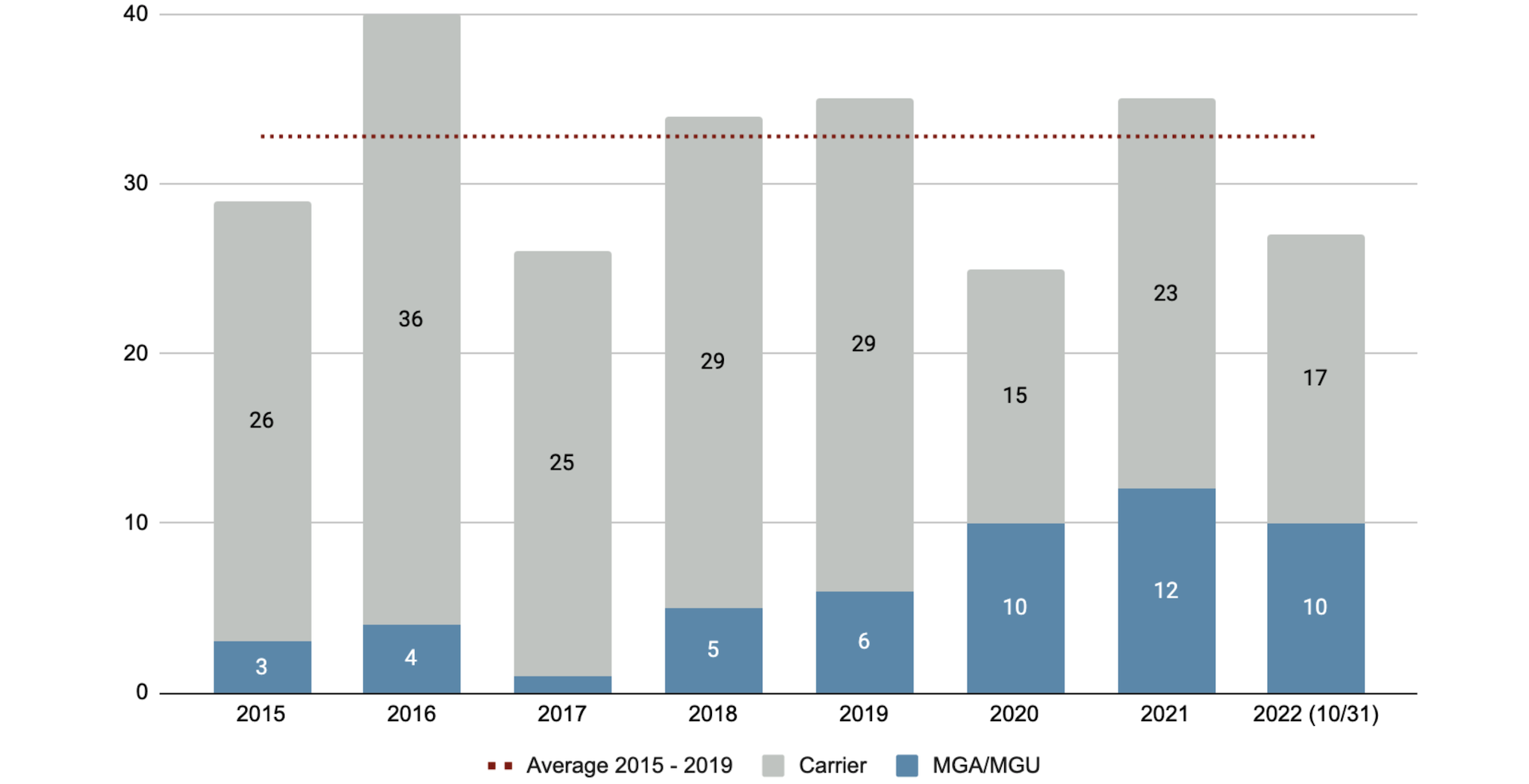

Figure 1 below plots the annual totals for core platform announcements. These range from 25 to 40 announcements per year over nearly eight years. There was a noticeable drop in 2020 during the early period of the pandemic, but there have been other years with a lower number of announcements, such as 2017. Using the average total from 2015 through 2019 as a benchmark (five “normal” years before 2020) we see that by 2021 the number of selection announcements had returned to a normal range.

Figure 1. P&C Core Platform Selections 2015 - 2022 as of 10/31/2022

Source: Coretech Insight, November 2022

The 27 selections in 2022 (as of 10/31) are lower than 2021, but already higher than 2020. Figure 2 below plots monthly highs, lows, and averages from 2015 - 2019. Except for brief divergences in January and mid-year, monthly results have tracked the average from prior years. If 2022 continues to follow these norms, the remainder of the year will be quieter for selection announcements and we’ll end the year at or slightly below the 2015-19 average of 33 selection announcements per year.

Figure 2. Monthly P&C Core Platform Selections

Source: Coretech Insight, November 2022

These results in 2021 and 2022 show, despite the disruption of a global pandemic and concerns about the strength of the US economy, the appetite for new P&C core platform deals has remained healthy.

There’s more to this story, though. While the number of annual platform selections has stayed in consistent ranges and returned to pre-pandemic levels after 2020, the nature of these new platform selections is changing.

Figure 3 below shows the annual selection totals by company size. The years 2015 through 2019 saw most new platform selection announcements from small to mid-size insurers with written premiums under $1B. Toward the end of these five years, we began to see announcements for insurer startups, but they were just a small minority.

Figure 3. P&C Core Platform Selections by Premium Tier

Source: Coretech Insight, November 2022

While the total number of selections decreased in 2020, selections from startups increased — the only category to increase in 2020. The other tiers have fluctuated since 2020, and the number of selections from mid-size and small insurers decreased in 2022, but the number of selections from startups has grown over the past two years to 30% of all announcements.

Figure 4 below shows the breakdown of these announcements between carriers and MGAs/MGUs. Reflecting increased activity among insurer startups, the number of new selections from MGAs/MGUs – the most common type of insurer startup – has increased over the past five years, too. Beginning in 2020 and continuing through this year, more than one-third of P&C core platform selection announcements have come from MGAs/MGUs.

Figure 4. P&C Core Platform Selections by Insurer Type

Source: Coretech Insight, November 2022

Along with a growing percentage of startups and MGAs, there has been a change in why insurers are selecting new core platforms. Figure 5 below shows the selection announcements organized by the following three objectives:

Legacy Modernization / Replacement – a selection to replace an existing system.

New Product Support / Greenfield – a selection by an established insurer to support a new product or greenfield initiative, without necessarily replacing an existing system.

Startup Platform – a selection of a platform by a startup insurer.

Figure 5 shows how, beginning in 2020, there have been fewer selections focused on legacy modernization and a growing number of new platform selections in support of new products and startup insurers.

Figure 5. P&C Core Platform Selections by Deployment Objective

Source: Coretech Insight, November 2022

This change in focus is impacting the types of platforms buyers are choosing. Figure 6 below shows selections categorized by the following three core platform types:

Modular — Platforms with broad capabilities and core modules that can be deployed together as an integrated suite or individually as standalone modules.

All-in-one — Platforms that are sold (and usually only deployable) as a complete, all-in-one platform with all modules.

Cloud Agile — Cloud-native platforms that have less prebuilt business functionality, but offer great flexibility and low-code/no-code capabilities.

Cloud agile platforms were hardly a factor in the five years leading up to 2020. With the increasing focus on new products and startups in recent years, where flexibility is essential, cloud agile platforms have been growing their share of new platform selections – from zero in 2015 through 2018 to one out of five in 2022.

Figure 6. P&C Core Platform Selections by Solution Type

Source: Coretech Insight, November 2022

These changes are also reflected in the top vendors for selection announcements for each deployment objective – legacy modernization vs. new products/startup platforms.

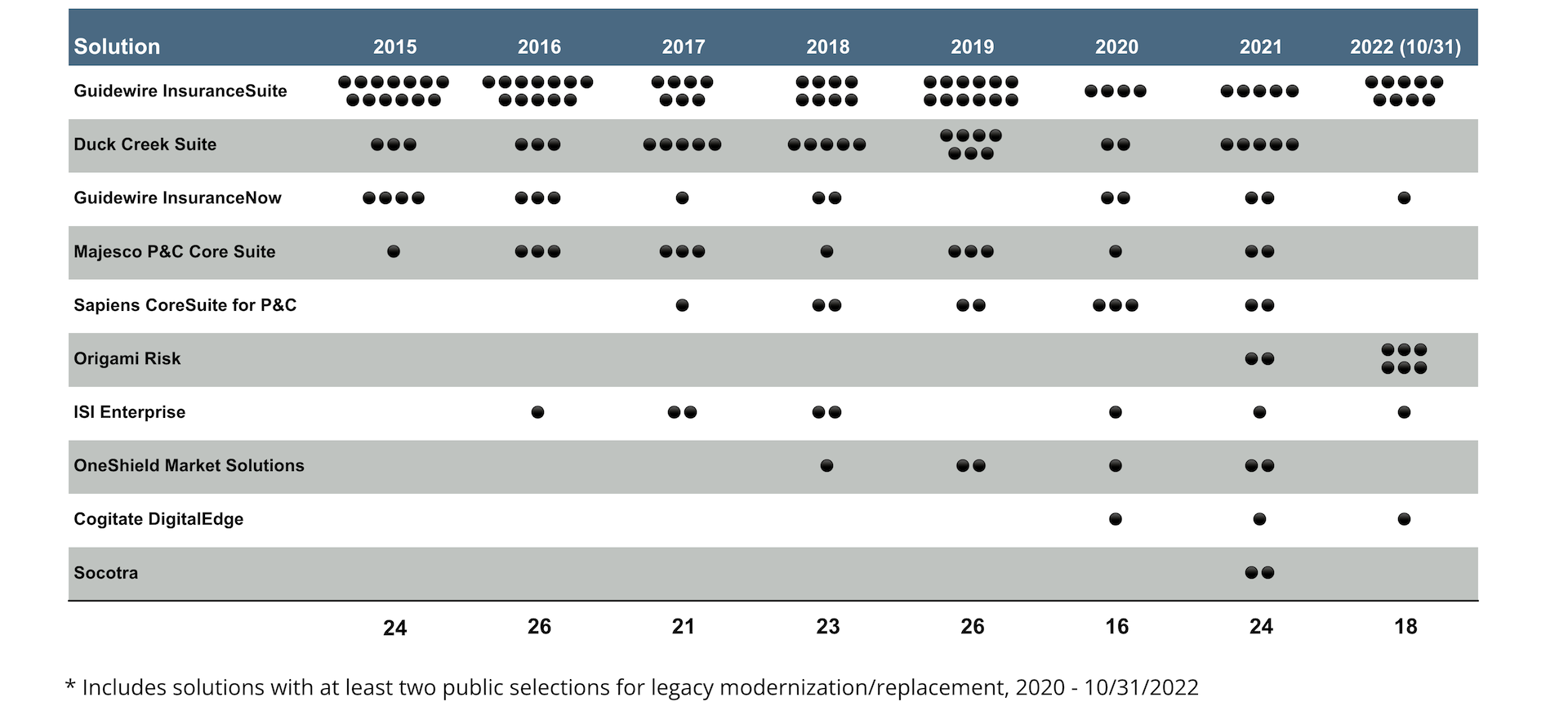

Table 1 below shows the top 10 vendors (out of 28) for legacy modernization selections. This table includes all vendors with two or more public selection announcements identified by Coretech Insight in support of legacy modernization from 1/1/2020 through 10/31/2022.

Table 1. P&C Core Platform Selections for Legacy Modernization

Source: Coretech Insight, November 2022

Table 2 below shows the top five vendors (out of 16) for selections for products/greenfield or startup implementations. This table includes all vendors with two or more public selection announcements identified by Coretech Insight in support of new products/greenfield or startups from 1/1/2020 through 10/31/2022. While there is overlap with the top vendors for legacy modernization, the table shows a different set of leaders when the objective is new products or startups.

Table 2. P&C Core Platform Selections for New Products, Greenfields, and Startups

Source: Coretech Insight, November 2022

Implications

The market for P&C core platforms has recovered from 2020 and remains healthy, with steady demand from buyers. Changes in buyer size, type, and focus, though, have implications for both buyers and sellers.

For buyers with legacy modernization initiatives:

Buyers focused on legacy modernization will be among a smaller pool of opportunities. Vendors view legacy modernization initiatives as desirable because they are larger in scope, more predictable, and more profitable than new product and startup implementations. There will be increased competition among vendors for legacy modernization opportunities. Buyers will enjoy more flexible terms and more negotiating power. Fewer opportunities and increased competition will put more pressure on weaker vendors. Verifying vendor viability should remain a key aspect of the selection process for buyers.

For vendors seeking legacy modernization opportunities:

To cut through the noise of increased competition, vendors focusing on legacy modernization must have crisp messaging about the customers they are best suited to serve, the business problems they solve, and how they will provide a clear, efficient path to business value. These shifts toward new products and startups in part reflect a weariness among buyers with vague assertions about the value of modernization on a large scale. Buyers desire to quickly realize quantifiable (and compelling) business value with improvements and new capabilities.

For buyers with startups or new product/greenfield initiatives:

Buyers with startup insurers or those focused on new products and/or greenfield deployments will also see more proactive engagement from vendors and more flexible terms. Some vendors will be squeezed out of legacy modernization opportunities by stronger competitors and will shift their focus to new products and startups. These markets and their requirements are very different. Some vendors will struggle to successfully make this transition. In addition to verifying vendor viability, it will remain important for buyers to push past marketing spin and verify solution capabilities and a vendor’s track record with similar customers.

For vendors seeking startup or new product/greenfield opportunities:

Given these trends, every vendor must be able to articulate and demonstrate how they support new products and startups. However, vendors with a history of primarily supporting traditional insurers with legacy modernization should be cautious and selective with startups or new product opportunities. These opportunities often have highly aggressive deadlines (driven by funding or regulations) and unusual requirements. When there is a poor match between the customer’s requirements and vendor platform capabilities, this can drive excessive custom development, reduce (or eliminate!) profit, and increase the risk of project failure.

The overall picture that emerges from this review favors buyers of core platforms, and puts more pressure on vendors. Vendors need to demonstrate their ability to support new products and startups, and secure their share of more lucrative legacy modernization opportunities. Those who succeed in only one of these categories will face future growth constraints. Vendors who only succeed with traditional legacy modernization run the risk of being perceived as “new legacy,” with a limited future. Vendors who only succeed with startups and new products will generate less revenue to fund their development and run the risk of being unable to scale. The key is to demonstrate both – the flexibility to support start-ups and new products, and the scale, competence, and resources for successful legacy modernization.

A Note on Methodology

In October and November 2022 we identified and reviewed 348 press releases (PRs) from P&C core platform vendors announcing the selection or go-live deployment of their platform or at least one core module (policy, billing, or claims) by US or Canadian customers. These PRs were published from 2015 through 10/31/2022 and featured on vendor websites and/or reported on by various wire services and news sites such as Business Wire, GlobeNewswire, PR Newswire, Insurance Innovation Reporter, and PropertyCasualty360.

Our objective was to use these PRs to track buying activity and trends among insurance carriers and MGAs/MGUs. From the initial set of PRs we excluded:

49 PRs on go-lives that had no information on the timing of vendor selection

48 PRs on customers that were not insurance carriers or MGAs/MGUs (such as TPAs, self-insureds, and government entities)

After these exclusions, 251 PRs from 33 vendors remained. Each included sufficient information to determine the timing of platform selection and track customer characteristics such as size, type, and deployment objective.

This review did not evaluate implementation timeframes or success rates — its focus was on the number and characteristics of selection decisions announced via press releases to gauge market activity and buying trends.

Jeff Haner is the founder of Coretech Insight, an independent advisory firm.

Coretech Insight serves P&C insurers and coretech providers who want to find customers and partners they can be wildly successful with. The firm provides research, frameworks, and insights to bring ideal customers and vendor partners together.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience as a customer, analyst, and vendor provides a unique perspective that cuts through the noise and finds ideal matches between insurers and coretech solution providers.

Are you an insurer looking for a reliable guide to core systems? Are you a coretech or insurtech vendor trying to connect with your ideal customers?

Contact Jeff at jeff.haner@coretechinsight.com