Early Indicators 2023 Q3 — Public Coretech Deals Drop to Prior Lows

How does P&C core platform buying activity in 2023 compare to prior years?

This is an update to Coretech Insight’s review of public coretech deals, which now includes 290 public announcements from 2015 through 2023 Q3.

After a slow start in early 2023, public deals dropped significantly in May. Deal volumes reached a new low in Q2 as buyers paused or shifted away from innovation toward safe bets for legacy modernization. 2023 may see the lowest number of new deals for all years in this review.

Overview

There are a few key questions ever-present in the minds of coretech buyers and vendors.

What is the demand for coretech platforms?

Are new trends or patterns emerging?

How are buyer priorities changing?

Judging by the first three quarters, 2023 will be an anemic year for new coretech deals that will challenge vulnerable vendors.

Analysis

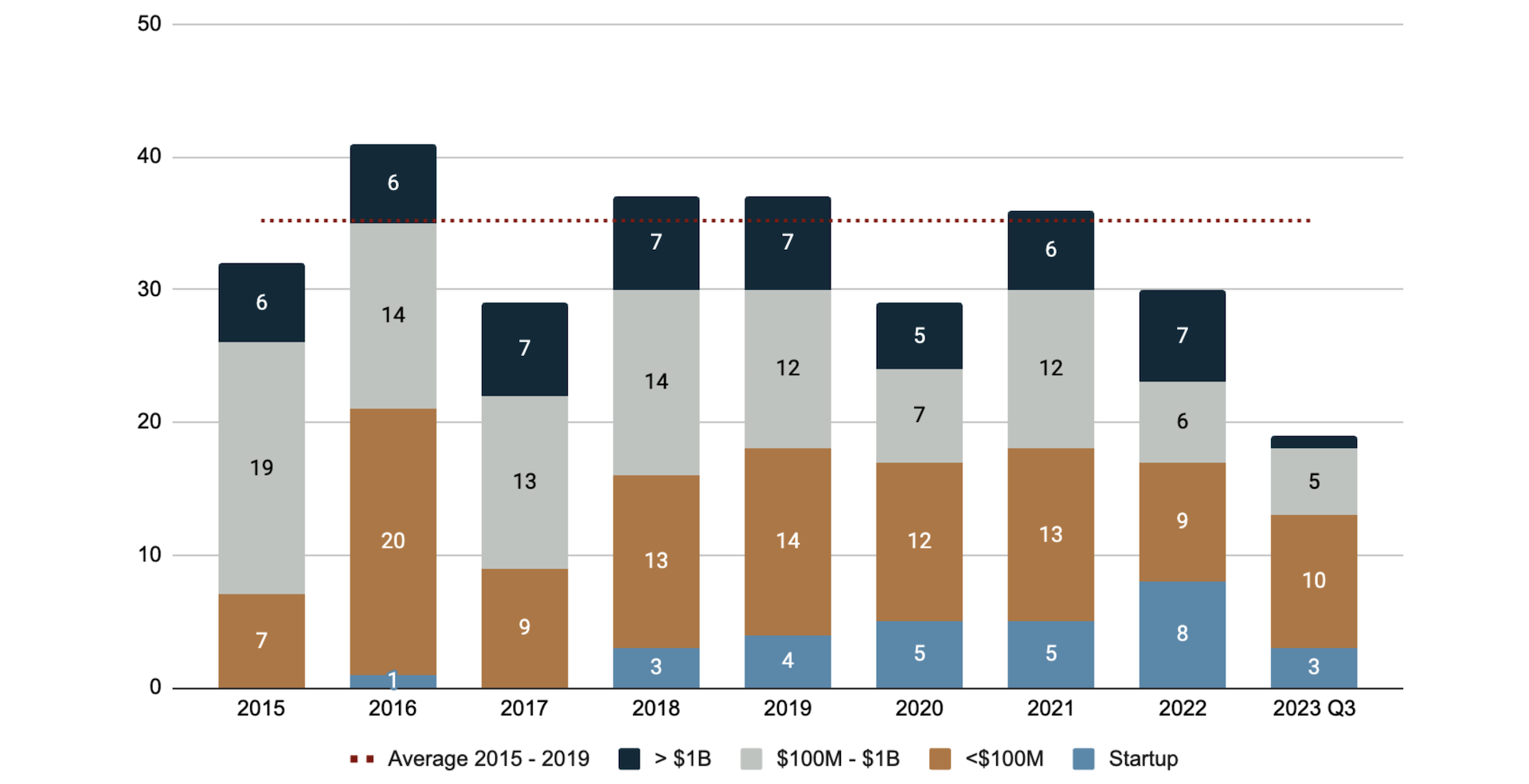

Figure 1 below shows core platform selection announcements from 2015 through the third quarter of 2023. Annual totals in prior years ranged from a high of 41 to a low of 29. There was a drop during the pandemic in 2020, a resurgence in 2021, and another drop in 2022.

Public deals in 2023 started slow but reached near-normal levels for the first quarter. However, deals in Q2 and Q3 fell significantly, with Q2 hitting a new quarterly low.

Figure 1. Public P&C Core Platform Selections, 2015 - 2023 Q3

Source: Coretech Insight, October 2023

Note: These totals do not reflect all new system selections. We estimate these cover 30 to 40% of all selections from P&C insurance carriers or MGAs/MGUs during these years. Although not a complete accounting of all deals, these announcements are valuable as public, verifiable records. See “A Note on Methodology” below for more details.

Figure 2 below plots 2023 public deals against a benchmark of monthly highs, lows, and averages from the five “normal” years of 2015 through 2019, prior to 2020. Monthly deals for 2022 are plotted with a black dotted line, and new deals for 2023 are plotted with a solid red line. This chart shows 2023 deal volumes tracking close to the benchmark averages in the first quarter, and then declining to below average in May and for the rest of the second and third quarters, except for the month of August.

Figure 2. Monthly P&C Core Platform Selections, 2015 - 2023 Q3

Source: Coretech Insight, October 2023

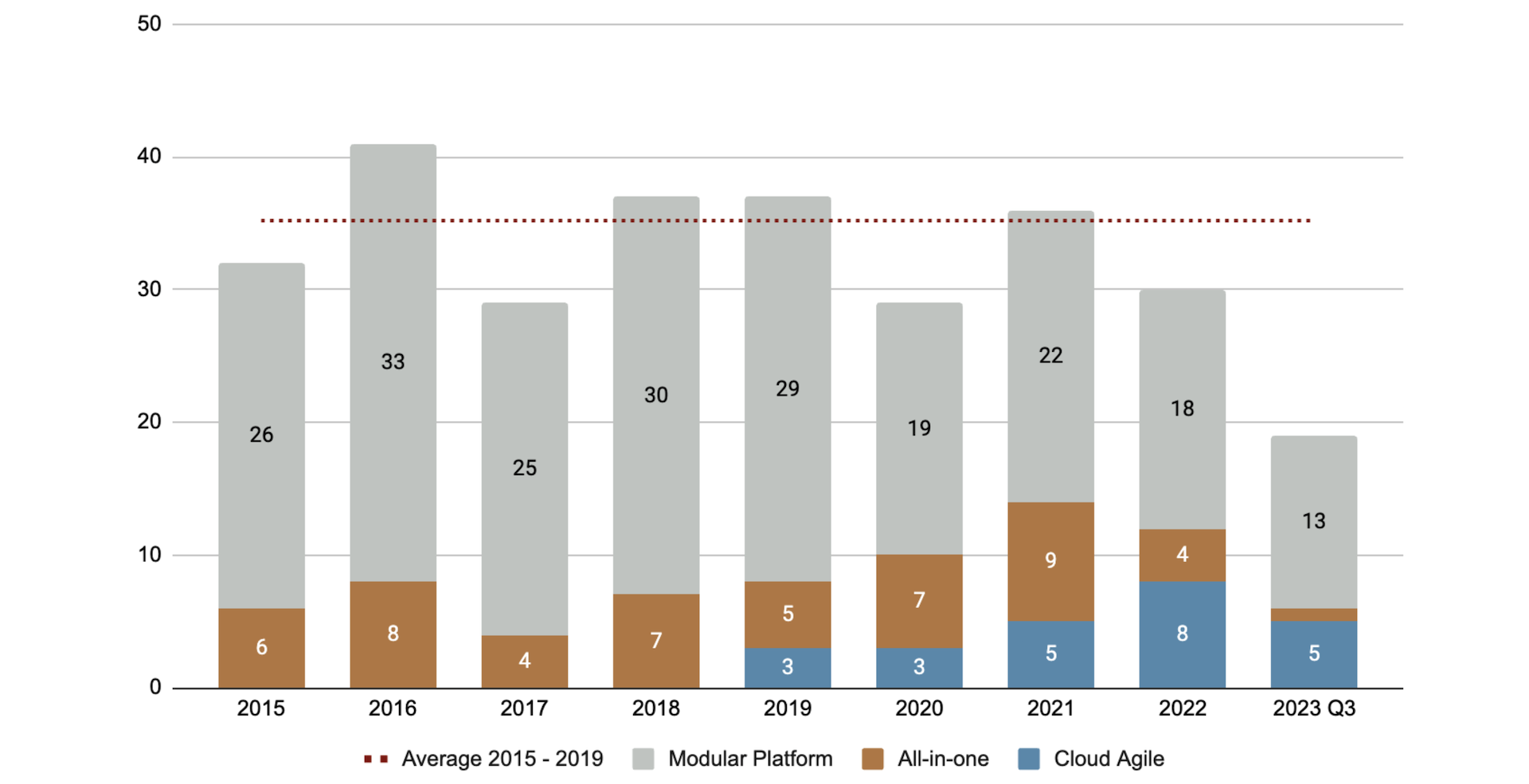

Within the composition of these deals, we see some changes to prior trends, as shown in Figures 3 through 6 below.

Most new deal activity has shifted to established insurers under $1B DWP. (See Figure 3.) There have been fewer deals with start-ups and large, $1B DWP+ carriers.

MGAs/MGUs have grown to represent a sizable portion of new deals over the past few years, and made up nearly 50% of all deals in 2023. (See Figure 4.)

Most new deals in 2023 (nearly 85%) were focused on “classic” legacy modernization. (See Figure 5.) Deals to launch new products or start-ups dropped significantly – only three deals focused on start-ups, and there were no deals by established insurers to launch new products.

Cloud agile platforms continue to see healthy adoption, representing just over a quarter of new deals. (See Figure 6.)

Figure 3. P&C Core Platform Selections by Premium Tier

Source: Coretech Insight, October 2023

Figure 4. P&C Core Platform Selections by Insurer Type

Source: Coretech Insight, October 2023

Figure 5. P&C Core Platform Selections by Deployment Objective

Source: Coretech Insight, October 2023

Figure 6. P&C Core Platform Selections by Solution Type

Source: Coretech Insight, October 2023

Vendors announcing public deals are a reflection of the emphasis on legacy modernization. Table 1 below tracks annual public deals from 2015 through the third quarter of 2023.

Table 1. P&C Core Platform Selections by Vendor and Premium Tier, 2015 - 2023 Q3

Source: Coretech Insight, October 2023

Table 1 illustrates a shift toward “safe bets” in the first three quarters of 2023. Core platform buyers are nearly all established mid-sized and small carriers and MGAs seeking to modernize legacy systems. Most vendors selected are well-established players offering mature core platforms with comprehensive functional capabilities.

Implications

In our last update, published in April, we commented on the buyer’s market that had emerged in coretech. There had been a downturn in the number of deals in late 2022, and concentration among vendors reporting new deals early in the year. This downward trend continued in 2023. However, coretech buyers are also showing signs of weakness.

RIFs and Reduced Investment Increase Pressure on Coretech Providers

Beginning in 2022, and throughout 2023, we have seen a wave of layoffs among insurers large and small – including established insurers with prominent, household names and newcomers that have been generating positive buzz in the insurtech space. Some insurance carriers have reported losses and layoffs for the first time in more than a century. When insurers shift to cost-cutting mode, the appetite for new legacy modernization and digital transformation initiatives fades rapidly.

As insurer buyers tightened their belts in 2023, VC investors also reduced their investment in insurtech/coretech. “The State of Global Insurtech 2023,” published in June by Dealroom, Mundi Ventures, MAPFRE, NN Group and Generali, noted that investment in insurtech had dropped by over 50% in the first half of 2023 compared to the prior year.

Reduced demand and reduced access to capital have hit vendors hard. The insurtech and coretech space is volatile. There is a regular churn of employees, and layoffs are common – especially among startups and younger companies. However, the frequency and size of coretech vendors that underwent layoffs in 2023 were notable. Several coretech vendors, including market leaders, have had (mostly unpublicized) layoffs in 2023. Some have had more than one round of staff reductions.

Challenging Conditions Favor Established Vendors

Conditions like these favor established coretech vendors with sufficient customers to remain viable from ongoing license and/or SaaS subscription fees. Most coretech vendors license their solutions based on a percentage of premiums. Each customer is essentially an annuity that provides an ongoing and typically consistent revenue stream. Some of these vendors also benefit from cloud migration projects with on-premises customers who signed on years ago, before cloud deployments were ubiquitous. Each cloud migration is another source of professional services and licensing revenue, and serves to cement the relationship between vendor and customer. Insurers in the market for a new core system will find established vendors with consistent revenues a safer bet in terms of vendor viability.

These conditions are very challenging for startups and vendors dependent on achieving growth targets, and those still refining and building out their core platform offerings. Until recently, coretech vendors could follow a plan to “make it to the next funding round” and remain viable even if they were not profitable. As funding has dried up and buyer demand has waned, these vendors may exhaust their resources and options. Insurers who see a better fit with startups and vendors less financially secure need to be diligent in their evaluations and prepare to get creative. They may need to craft non-traditional agreements that include both licensing and investment to help ensure the viability of their vendor candidates.

With the drop in both buyer demand and investment capital, Coretech remains a buyer’s market, and their negotiating position is strong. Those with the resources and willingness to brave the current economic uncertainties have an opportunity to bargain and lock in very favorable terms.

Recommendations for Insurers Seeking a New Core Platform

Proceed deliberately and emphasize vendor viability in your selection and evaluation criteria for all vendors, whether large or small, new or old.

Insist on full transparency about financials from vendor candidates.

Develop contingency plans and establish safeguards, such as securing access to your data and platform source code, in the event of a sudden change in vendor fortunes.

Establish and agree to an exit plan with vendor candidates before moving forward with any long-term agreements.

Due diligence and contingency planning should be a part of any core system selection, but they are even more critical under current market conditions.

A Note on Methodology

This research is part of Coretech Insight’s ongoing review of press releases (PRs) from P&C core platform vendors announcing the selection of or go-lives with their core platform or at least one core module (policy, billing, or claims) by US or Canadian customers. The PRs reviewed for this research covered coretech selections made from 1/1/2015 through 9/30/2023 and featured on vendor websites and/or reported on by various wire services and news sites such as Business Wire, GlobeNewswire, PR Newswire, Insurance Innovation Reporter, and PropertyCasualty360.

Our objective is to track buying activity and trends among insurance carriers and MGAs/MGUs. From the initial set of PRs we excluded:

PRs with no information on the timing of vendor selection

PRs on customers that are not P&C insurance carriers or MGAs/MGUs (such as life insurers, TPAs, self-insureds, and government entities)

For this 2023 Q3 update, we reviewed a total of 290 PRs with sufficient information to determine the timing of platform selection and track customer characteristics such as size, type, and deployment objective.

Sharp-eyed readers will note minor differences in prior year data in these findings vs. earlier updates. We periodically identify additional PRs from prior years during our ongoing reviews and incorporate these into our analysis. These additions have not impacted overall trends or conclusions.

This review did not evaluate implementation timeframes or success rates — its focus was on the number and characteristics of selection decisions announced via press releases to gauge market activity and buying trends.

These public announcements do not reflect all new system selections during this period. For various reasons, such as client confidentiality, a conservative approach to promotion, or even a lack of marketing resources, vendors often do not publicize new client wins. We estimate these press releases cover 30 to 40% of all new P&C core platform selections from P&C insurance carriers or MGAs/MGUs during these years.

Although not a complete record of all deals, these announcements are valuable because they provide a public, verifiable record with details jointly approved by buyers and sellers. They represent a high-quality (and consistent) sample of activity in the P&C core platform market.

Jeff Haner co-founded Coretech Insight, an independent advisory firm, in 2022.

Coretech Insight provides research, frameworks, and insights focused on matching P&C insurers with ideal coretech providers so that, together, they can be wildly successful.

Jeff has served in senior IT, advisory, and marketing roles with Deloitte, Oliver Wyman, NJM Insurance Group, Gartner, and BriteCore. While with Gartner he authored the Magic Quadrant for P&C Core Platforms. Jeff’s experience in the roles of coretech customer, analyst, and vendor provides a unique perspective that cuts through the noise and finds ideal matches between insurers and coretech solution providers.

Are you an insurer looking for a reliable guide to core systems?

Are you a vendor seeking insight and content to connect with your ideal customers?

Contact Jeff at jeff.haner@coretechinsight.com